A Trust is the commitment or duty set on one in whom certainty or authority is place; it’s anything but a certainty rested in an individual by passing on to him the legitimate title to property which he is to hold to serve others. Along these lines, the “Trustee” obligation remembers insurance of legitimate proprietorship for the Trust property, the protection of the Trust property and channelizing the pay from the Trust property as per the aims of the maker of the Trust. In this article, we take a gander at the methodology for framing a Charitable Trust in India. Anybody considering setting up a trust needs not exclusively to ensure that the person is making a substantial legitimate design, yet in addition to comprehend the idea of the trust, the obligations of trustees, and the privileges of recipients.

Consider the following points before forming trust

- Is it accurate to say that you will surrender coordinate authority over resources moved to the trust? If not, the trust might have the view as a change self-image of yourself, have ignored, and your justification enlisting a trust might have crushed.

- It is feasible to structure a trust so that you are a trustee and recipient, if there is an unmistakable partition among control and possession, and satisfaction.

- Does a trust find a way into your general domain plan?

- Will the trust have utilization principally to try not to make good on charges? Assuming this is the case, odds are acceptable that SARS will assault the trust, and may even negligence it. If you set a trust up as a feature of your home arranging, SARS won’t assault your trust.

- Does the advantage of the trust legitimize the expense and organization engaged with setting fully operational the trust? Advantages incorporate any sums that you can compute, just as hazard relief that is hard to figure precisely.

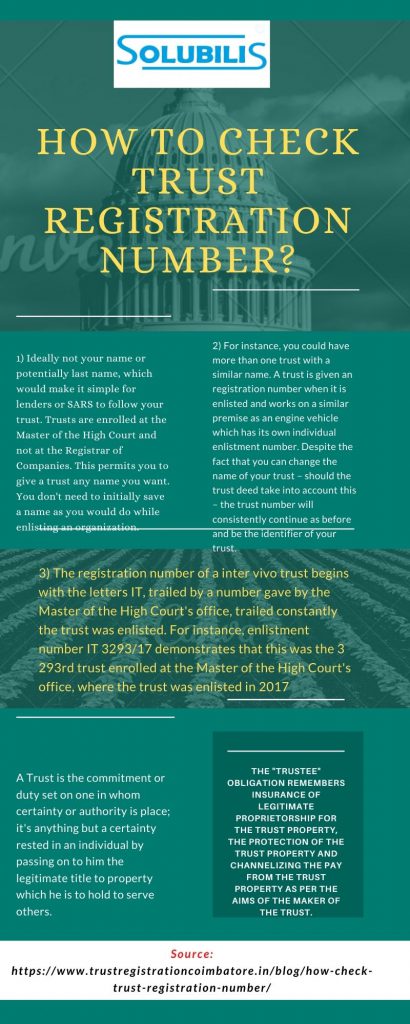

Trust number

Ideally not your name or potentially last name, which would make it simple for lenders or SARS to follow your trust. Trusts have the registration at the Master of the High Court and not at the Registrar of Companies. This permits you to give a trust any name you want. You don’t need to initially save a name as you would do while enlisting an organization.

For instance, you could have more than one trust with a similar name. A trust has the provision of registration number when it has enlistment and works on a similar premise as an engine vehicle which has its own individual enlistment number. Despite the fact that you can change the name of your trust – should the trust deed take into account this – the trust number will consistently continue as before and be the identifier of your trust.

The registration number of a inter vivo trust begins with the letters IT, trailed by a number gave by the Master of the High Court’s office, trailed constantly the trust had enlisted. For instance, enlistment number IT 3293/17 demonstrates that this had the 3 293rd trust enrolled at the Master of the High Court’s office, where the trust had enlisted in 2017. A trust will consistently have registration concerning the Master of the High Court’s office where it had enlisted. Each Master of the High Court’s office has its own arrangement of numbers for consistently.

Type of trust

Choose whether you need an optional or a vested trust. In an optional trust, the trustees reserve the option to choose how much pay (or funding) to grant to every recipient, while in a vested trust, the pay and capital additions vest in the recipients. Intricacies can emerge in vested trusts in case of a recipient’s bankruptcy or passing.

Name of the founder

The author is the individual who sets up the trust. This must be the individual who proposed setting up the trust and who moves essentially the underlying gift to the trust. The author may in this manner not be the legal advisor who sets up the trust, or his/her secretary.

The organizer is necessary to genuinely pay the sum or move resources depicted in the trust deed as the underlying gift.

There might be more than one organizer of a trust. This individual can’t save any sole rights in the trust deed, as it might have negative expense and different results.

Administrative procedures

Administrative procedures, for example, the calling for and leading of trustees’ gatherings, casting a ballot rights, dynamic and debate goal methods, alongside any denial rights, ought to be plainly accommodated in the trust instrument. Guarantee that the trustees can and will follow the “rules” set out in the trust instrument. Inability to accomplish this might be demonstrative of a modify self-image trust.

Guarantee that the arrangements you embed into the trust instrument are common sense, giving you the insurance you need without being unreasonably burdensome.

Consider the ramifications of a larger part choice necessity in the trust instrument. Requiring a consistent choice could leave your trust in impasse, should certain trustees become obstructive. Over the top forces given to a particular trustee could add up to say trustee assuming responsibility for the trust.

Refer to the arrangements of Section 7(6) of the Income Tax Act, whereby all circulated trust pay will be burdened in the possession of the contributor/funder in the event that he/she can reject appropriations or end the trust. A comparable arrangement applies to capital additions dispersed to recipients (Paragraph 71 of the Eighth Schedule to the Income Tax Act).

Points to ponder

The trustees’ exception from security should explicitly have management in the trust instrument

Arrangements identifying with payment of assessments should the organizer, benefactor or funder become obligated

Rules and limitations in regards to the conveyance of pay and capital

The name of the individual who will play out the trust’s bookkeeping obligations (ideally a accountant) and whether the bookkeeping records of the trust should be evaluated. In spite of the fact that it’s anything but a prerequisite that a trust’s records are evaluated, this should be possible at the trustees’ carefulness.

Regardless, make sure to follow methodology as far as how they are specified in your trust instrument. Neglecting to do so may demonstrate that you have neglected to notice the trust deed.

Try not to specify the name of your accountant/auditor in the trust deed, as it will expect you to change your trust deed should you choose to supplant him/her. Naming your accountant and afterward selecting another accountant sometime in the not too distant future will mean naming another accountant with the Master of the High Court.